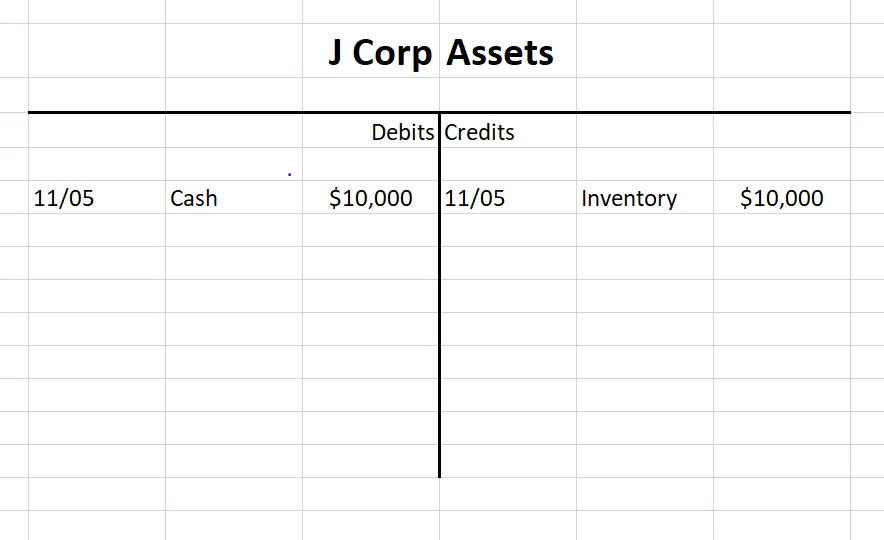

In this basic accounting lesson, we look at the double-entry accounting concept. We explain what Debits and Credits are and the accounts that are debit and t. What is a Debit and Credit in Accounting? Whenever you record an accounting transaction, one account is debited and another account is credited. In addition, the amount of the debit must equal the amount of the credit. This is called double-entry bookkeeping. From a math perspective, think of a debit as adding to an account, while a credit is subtracting from an account.

- Debit And Credit In Accounting

- Debit And Credit In Accounting Meaning

- Debit And Credit In Accounting Excel

Debit and credit accounts can be a very confusing concept in accounting. Kashoo explains the difference in a way that helps clarify any confusion. Debits and credits are used in a company's bookkeeping in order for its books to balance.Debits increase asset or expense accounts and decrease liability, revenue or equity accounts.Credits do the reverse. When recording a transaction, every debit entry must have a corresponding credit entry for the same dollar amount, or vice-versa.

Pixave 1 0. Debit and Credit Accounts and Their Balances. Fcpeffects organic light leaks download free. There are several different types of accounts in an accounting system. Each account is assigned either a debit balance or credit balance based on which side of the accounting equation it falls. Here are the main three types of accounts. All normal asset accounts have a debit balance.

Effect on values in the debit or credit columns

If a value is placed into the credit column of the assets account, it will decrease the total value of that account.

If a value is placed into the debit column of the expenses account the total of that account will increase..

..you get the idea!

Let's use a simple business transaction to see this in action:

On 4 April Mr Jones bought a box of copy paper for the office costing $15.00 using a business check/cheque.

Following the double entry rules, two bookkeeping ledger accounts will be affected:-

- the bank account - in the books we want to show that money has gone out of the bank account thus decreasing the bank balance.

- the stationery account - the money has been used to buy a stationery item thus increasing the expenses balance.

Debit And Credit In Accounting

t ledger example

Can you see the T!

From this illustration you will observe that the $15.00 has been placed on the left side of the stationery ledger account and on the right side of the bank ledger account.

t ledger Opening Balances

All asset, liability and equity accounts will have an opening balance at the beginning of a new financial year.

These balances are the closing balances brought forward from the previous financial year.

The balances in the asset accounts are usually debits.

The liabilities and equity balances are usually credits.

In the above ledger illustration, the bank ledger has an opening balance of $1,050.00.

This means that at the end of the previous financial year this business had that much money in their bank account.

The revenue and expenses accounts are always cleared at the end of a financial year so they start the new year with a zero balance.

Now, say if Mr Jones used the same check/cheque to buy several different items such as:

- $15.00 for paper

- $200.00 for a printer and

- $28.00 for a book for personal use

What would the debits and credits look like? See below.

t ledger example for Expense purchases

- The stationery ledger is being increased with a debit which adds to the overall total of business expenses.

- The office equipment ledger is being increased with a debit which adds to the value of the assets.

- The drawings ledger is being increased with a debit which adds to the amount of personal money the owner takes/spends.

- The bank account is being decreased because, obviously, the money has been spent!

Note that the debits of the first three ledgers add up to the total credit in the bank ledger. Airradar 3 1 5 download free.

There is no need to split the credits out.

Debit And Credit In Accounting Meaning

Go here to learn more about bookkeeping ledgers.